Wind Turbines Incentives

Depending on where you live, the cost of installing and operating a wind turbine can be significantly reduced with government or local incentives, tax rebates, grants and Feed-in Tariffs. These can differ widely internationally and regionally.

Some information can be found below. For more detail on the schemes that are available to you, contact us and we can advise on available grants and incentives, as well as provide information on how you may be able to sell any excess power you generate.

United Kingdom

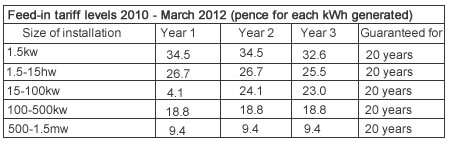

Residents of England, Scotland & Wales, who have installed renewable energy technologies, including a small wind turbine, have been entitled to claim a Feed-in Tariff (FIT) on qualifying products since 1st April 2010. This is a tariff for the generation of renewable energy – the rate for an average small wind turbine is 26.7pence per kWh generated (28p from 1st April 2011). Increased revenue can be received by selling surplus energy back to the grid / distribution network operator at an additional 3pence per kWh. Once a system has been registered, the tariff levels are guaranteed for the period of the tariff and index-linked. Also, for individuals this income is tax free and for businesses this investment will qualify for 'writing down' allowances.

To qualify for FiTs it is necessary to install a Microgeneration Certification Scheme (MCS) approved turbine which must be installed by a MCS approved installer. Northern Energy Solutions can provide and install such a system